Michael Littaur

Author

Entrepreneur Michael Littaur always knew he was both American and Dutch because of his American mother, despite being born and raised in the Netherlands. However, he had no idea about his tax obligations in the US. When he sold his business, he discovered that he also had to file tax returns in America. Then, together with Daan Durlacher, he founded the company Americans Overseas so that others can be well informed in advance and not have to make the same mistakes they did.

Born in the 1970s in the Netherlands to an American mother and a Dutch father, Michael soon began his working life as an entrepreneur. When he himself was completely up-to-date with his U.S. tax obligations, he and Durlacher decided to start a company where informing and connecting people is key.

2014

Employed since

4.8 out of 5

Average review score

3

Number of languages fluent

Experience

Michael can draw on his years of experience as a successful entrepreneur. As a result, it didn’t take him long to master the knowledge and expertise surrounding America’s citizenship-based tax system.

No one should be surprised by unexpected tax liabilities. That’s why we want to help others avoid the mistakes we made

Job and role

Michael knows all about the complicated U.S. tax rules for Americans Overseas. Thanks to his unique background – having grown up in the Netherlands with a New York mother – he understands better than anyone how difficult it can be to comply with the tax rules as an American overseas. This experience led him to specialize in this area. Every day he is committed to ensuring that Americans Overseas remains at the forefront of the latest technology to help clients file their returns as easily and securely as possible.

Interviews with Michael Littaur in national media:

Top 5 Frequently Asked Questions

Understanding the US tax system, the obligations and all the additional terms can be difficult. Especially if one lives outside of America. Is your question not answered? Contact us.

-

Who is required to file taxes in the US?

U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income

Read more... about Who is required to file taxes in the US? -

U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income

Yes, US citizens are required to file taxes on their worldwide income, regardless of where they are living.

Read more... about U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income -

How can I cash my US check?

Received an American check? You can cash your check in the following ways: cash the check at your own bank, transfer to another person (endorsement), cash checks using an online service or cash the check by another bank.

Read more... about How can I cash my US check? -

Are there any special tax forms required for US citizens living abroad?

US citizens living abroad may be required to file Form 2555 and/or Form 1116 to claim the foreign-earned income exclusion.

Read more... about Are there any special tax forms required for US citizens living abroad? -

What is FBAR filing?

FBAR (Foreign Bank Account Report) filing is the requirement for certain U.S. individuals and entities to report their foreign financial accounts to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. The FBAR filing requirement applies to U.S. persons who have a financial interest in, or signature authority over, one or more foreign financial accounts, if the aggregate value of those accounts exceeds $10,000 at any time during the calendar year.

Read more... about What is FBAR filing?

News by Michael

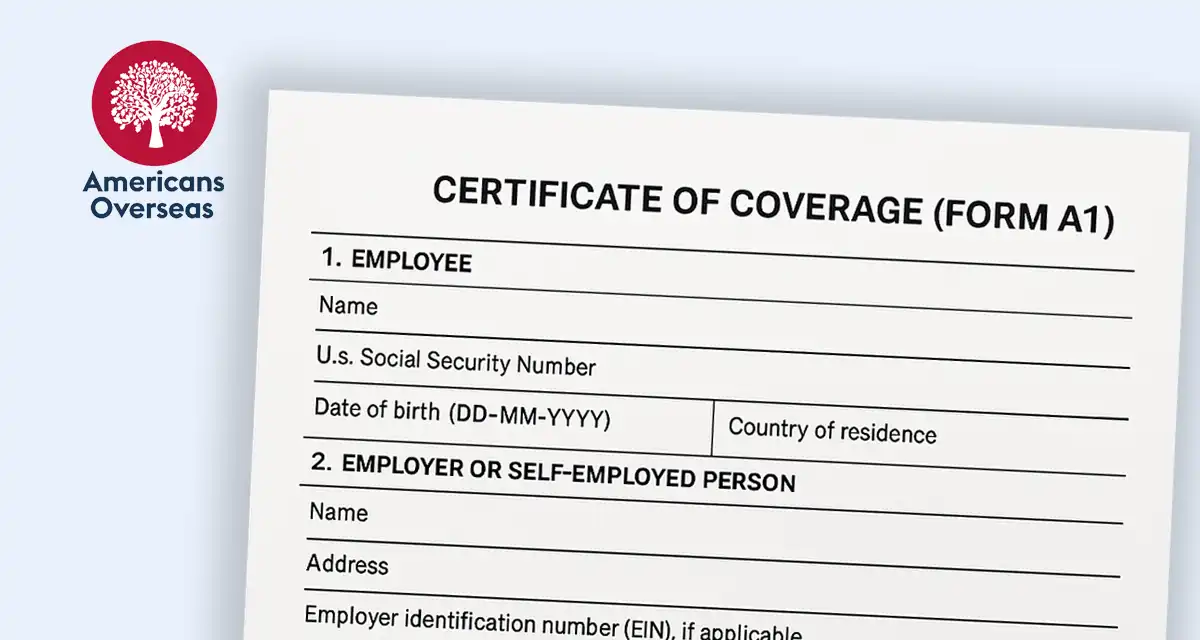

Certificate of Coverage (Form A1)

When are you considered a taxable green card holder (even if you left)

IRS hunts Bitcoin and crypto investors who haven’t paid their taxes

I own Bitcoins or crypto, how does IRS view them?

You’ve received a FATCA Rabobank letter. Now what?

Do I have to file tax returns during my retirement abroad?

I was born in the United States and given up for adoption. Am I an American?

Double taxation

I’ve made investments in the stock market; is that a problem?

Non-American spouse filing tax returns?

When are you a US citizen?

I got a FATCA letter from the bank, now what?