What actually happens at the IRS

More and more reporting obligations are being implemented for U.S. citizens living overseas. They are creating a real risk that the average individual who may be unaware of the U.S. worldwide tax regime could run afoul of draconian failure to file penalties in addition to a higher cost of being compliant.

On the other hand, the IRS’s budget has been cut by more than $1.2 billion since 2010. This makes it harder for them to adequately engage with these new rules.

Some interesting facts about the current IRS environment:

- 45% of overall IRS leadership has left since October 2011.

- 25% of the IRS workforce will be eligible to retire in 2016.

- 40% of the workforce will be eligible to retire in 2019.

- More than 50% of the IRS workforce are age 50+.

- The total IRS workforce is approximately 87,000 employees, 13,000 less than in 2010 and the IRS expects to lose 3,000 full-time employees in the upcoming fiscal year.

- According to the National Taxpayer Advocate, the IRS training budget has been slashed by 80% since 2010. Leaving agents less equipped to perform their jobs appropriately.

- The IRS receives more than 100 million telephone calls and 10 million letters per year.

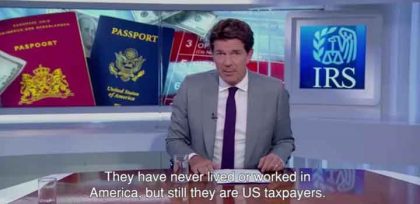

U.S. tax system

Many Americans residing outside of the United States are familiarizing themselves with the U.S. tax system. Particularly in this past year due to FATCA. They are asked by their non-U.S. banks to certify, under penalty of perjury, certain tax documents simply to hold the most basic checking or savings account.

Following that is the filing of U.S. individual income tax returns. Foreign bank account reporting forms for those Americans who have lived their entire life outside the United States, amassed savings there and have no financial ties to the United States.

A ‘non-willful’ taxpayer is eligible for the Streamlined Procedures, as of July 1, 2014. These Streamlined Procedures allow a taxpayer to file the previous three years of U.S. income tax returns and six years of FBAR forms without penalties. However, a mystery remains as to what happens to the declarations once they are submitted to the IRS under these Procedures.

the IRS does not notify the taxpayer that their ‘non-willful statement’ has been accepted

One of the stipulations of the Streamlined Procedures is that the IRS does not notify the taxpayer that their ‘non-willful statement’ has been accepted. Or that no further penalties, civil or criminal charges will be assessed.

The statute of limitations starts (or restart) once the submission is made. One of the stipulations of the Streamlined Procedures is that the IRS does not notify the taxpayer that their ‘non-willful statement’ has been accepted. Or that no further penalties, civil or criminal charges will be assessed.

The statute of limitations starts (or restart) once the submission is made. This leaves the individual, new to U.S. reporting rules, in a state of ambiguity. The individual may receive an automated notice if tax was calculated incorrectly or if additional interest is due.

What if the notice is incorrect? To go further, what if a simple, low-risk overseas taxpayer decides that he wants to become compliant on his own. And that he wants to speak to an agent about the forms to complete.

I am certain that I am not the only CPA who has waited more than 90 minutes on the phone to speak to a revenue agent. Got a busy signal while trying to call their international hotline (+1-267-941-1000). Or simply got an automated message stating that “all agents are busy, call back in a few hours.”

According to the IRS Commissioner, “After five years of budget cuts, and a hiring freeze that has lasted four years, people need to understand that the IRS is going to have to do less with less”. And: “If people think they are not going to get caught if they cheat….the system will be put at risk”.

Voluntary compliance

The U.S. tax system is built on the notion of self-assessment and voluntary compliance. This does not mean that taxpayers living abroad should forego any of their U.S. filing obligations or adhere to what is sometimes referred to as the “audit lottery”. This is strongly discouraged.

Taxpayers delaying their foreign reporting obligations, completely and accurately, are at risk of a public disclosure. The Department of Justice (DOJ) is continuously issuing John Doe summonses to foreign financial institutions to provide names of their U.S. account holders which generally come without any warning.

Taxpayers who are being investigated before they come forward are disqualified from entering the Streamlined or OVDP procedures. Therefore they cannot benefit from the lower or no penalty opportunities.

Also, it is important to mention that as of August 20, 2015, the list of Foreign Financial Institutions that are considered “Facilitators” (of U.S. tax avoidance and have entered plea agreements with the DOJ) totals 43 from which 30 institutions were added since March 2015.

So far, the IRS and DOJ are focused mostly in Western Europe. With FATCA, it is only logical that the spotlight will expand. Will your bank be #44, 45…. or 70 by the time you read this post?

Contact us for more information

Richard Barjon is a Senior Manager in the Private Client Services practice of WeiserMazars LLP in the Chicago office. He has over 10 years of experience dealing with gift, estate and income tax planning for high-net-worth individuals and families.

Frequently asked questions

Understanding the US tax system, the obligations, and all the additional terms can be difficult. Especially if one lives outside of America. Is your question not answered? Contact us.

-

Who is required to file taxes in the US?

U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income.

Read more... about Who is required to file taxes in the US? -

Do US citizens living abroad still have to file taxes in the US?

Yes, US citizens are required to file taxes on their worldwide income, regardless of where they are living.

Read more... about Do US citizens living abroad still have to file taxes in the US? -

How can I cash my US check?

Received an American check? You can cash your check in the following ways: cash the check at your own bank, transfer to another person (endorsement), cash checks using an online service or cash the check by another bank.

Read more... about How can I cash my US check? -

Are there any special tax forms required for US citizens living abroad?

US citizens living abroad may be required to file Form 2555 and/or Form 1116 to claim the foreign-earned income exclusion.

Read more... about Are there any special tax forms required for US citizens living abroad? -

What is FBAR filing?

FBAR (Foreign Bank Account Report) filing is the requirement for certain U.S. individuals and entities to report their foreign financial accounts to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. The FBAR filing requirement applies to U.S. persons who have a financial interest in, or signature authority over, one or more foreign financial accounts if the aggregate value of those accounts exceeds $10,000 at any time during the calendar year.

Read more... about What is FBAR filing?