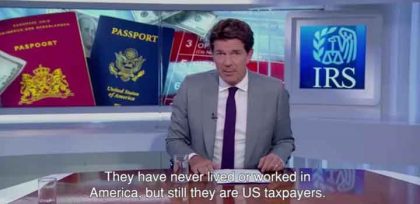

NBC: Americans living and working overseas penalized by Trump’s tax reform

According to NBC the United States needs to stop penalizing Americans living and working overseas.

The tax reform bill was signed into law by President Donald Trump in December 2017. One of the biggest missed opportunities in the new law is that it fails to stop double-taxing expats living abroad.

On top of paying taxes in their country of residence, U.S. citizens who live overseas must also file U.S. taxes. This system of citizen-based taxation (CBT) is practically unique to the U.S., with only one other nation, Eritrea, sharing the same approach.

Citizen-based taxation negatively affects Americans living abroad

In fact, it is a 150-year-old relic that started with an effort to tax Civil War draft dodgers who had fled to Canada. Just as the double taxation of international profits hurt U.S. companies and put them at a disadvantage in the global economy, citizen-based taxation negatively affects American individuals and families living in other countries.

Under the current system, Uncle Sam taxes US persons and U.S. green card holders on global income, no matter where they reside and earn a living.

Americans residing in a foreign country must file U.S. taxes

An American residing in a foreign country pays taxes in the country of residence and receives in return government services from that country — roads, education, medical plans, social security programs, police forces, etc. Under CBT, the American abroad must also file U.S. taxes and pay the marginal income tax to the IRS if U.S. income taxes exceed those paid in the country of residence.

Trump Toll tax: Problems for Americans living and working overseas

This system also makes it difficult for Americans abroad to save and invest, as foreign currency fluctuations result in phantom capital gains and U.S. citizens living in some countries must pay into two social security systems.

For some Americans living and working overseas, the unreasonable tax and regulatory burden imposed by the U.S. government has potentially grown more than they can bear. The past year has seen Americans continue to renounce their U.S. citizenship at record rates.

There was hope that tax reform would fix this mistreatment by implementing a residence-based system. Under residence-based taxation, the U.S. government would tax Americans living overseas in the same manner it currently taxes foreigners with U.S.-sourced income or U.S.-based assets. A residence-based system of taxation would be simpler than the current system, fairer, and would end the aforementioned predicaments.

Sadly the system of citizen-based taxation stays in place for the foreseeable future, meaning that Americans living and working overseas must file their US tax.

Americans Overseas and Trump tax reform

Need more information about the US tax reform and the impact for Americans living and working overseas? Contact Americans Overseas, we help Americans living abroad to become US tax compliant in an organized way and avoid unnecessary double taxation. Based on your personal situation, we introduce you to the appropriate US tax advisor in our network. They will make you a tailor-made offer to help with your tax filings. Free of charge and free of any obligations.

Contact us for more information

Source NBC

Frequently asked questions

Understanding the US tax system, the obligations, and all the additional terms can be difficult. Especially if one lives outside of America. Is your question not answered? Contact us.

-

Who is required to file taxes in the US?

U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income.

Read more... about Who is required to file taxes in the US? -

Do US citizens living abroad still have to file taxes in the US?

Yes, US citizens are required to file taxes on their worldwide income, regardless of where they are living.

Read more... about Do US citizens living abroad still have to file taxes in the US? -

How can I cash my US check?

Received an American check? You can cash your check in the following ways: cash the check at your own bank, transfer to another person (endorsement), cash checks using an online service or cash the check by another bank.

Read more... about How can I cash my US check? -

Are there any special tax forms required for US citizens living abroad?

US citizens living abroad may be required to file Form 2555 and/or Form 1116 to claim the foreign-earned income exclusion.

Read more... about Are there any special tax forms required for US citizens living abroad? -

What is FBAR filing?

FBAR (Foreign Bank Account Report) filing is the requirement for certain U.S. individuals and entities to report their foreign financial accounts to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. The FBAR filing requirement applies to U.S. persons who have a financial interest in, or signature authority over, one or more foreign financial accounts if the aggregate value of those accounts exceeds $10,000 at any time during the calendar year.

Read more... about What is FBAR filing?