International Investment: IRS tells banks not to close accounts just because of missing tax ID number

According to International Investment, the IRS has eased the rules of FATCA compliance. Banks are not required to close accounts of their accidental American clients because of missing tax ID number.

IRS eases rules of FATCA

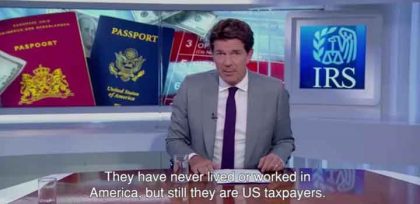

The US Internal Revenue Service has eased the rules of FATCA compliance by telling banks overseas that they are not required to close the accounts of their accidental American clients who have not provided their tax identification number by January 2020.

FATCA was passed in 2010 and forces banks wanting to operate in the US to report any assets held by American citizens overseas.

While FATCA is aimed at tax avoidance, it has created problems for many American expats, dual nationals, and ‘accidental Americans’ who have been rejected by retail banks seeking to avoid hassle and risk.

Accidental American clients must provide missing tax ID numbers or lose their bank account

Thousands of accidental American clients have been told by their banks that they will lose their accounts unless they provide a US tax ID number before October 1.

However, the IRS amended its FATCA guidance page to ease the transition period. It now states that failure to obtain an account holder’s US TIN is not necessarily ‘serious non-compliance,’ and does not imply that the client’s account must automatically be closed because of the missing tax ID number.

Instead, it sets out a procedure for resolving the difficulty, at least in jurisdictions that have a so-called Model 1 FATCA agreement with the US.

IRS will discuss the problem of missing tax ID number

Even if the IRS deems the financial institution to be in “significant non-compliance”, it will discuss the problem with the foreign jurisdiction’s tax authority over the following 18 months.

The US taxes individuals globally based on their citizenship, meaning they must file income, estate, and gift tax returns with the IRS. About 9 million Americans reside abroad, according to the US Department of State

Get help from Americans Overseas

We, the founders of Americans Overseas, were born in the Netherlands and obtained our American nationality through our (American) mother.

When we heard about the US tax system for the first time around 2013, we were in total disbelief (it can’t be true!), anger (how can they do this?), fear (am I going to get fined or pick up other problems?), and panic (what should I do?). It is (unfortunately) true that there is an additional American tax levy. But there’s no information from the local government, and when approached, the consulate referred us to the IRS, and the IRS was impenetrable.

That’s why we started this initiative to help people from all over the world by providing proper information about the US tax system to avoid unnecessary panic and offering help free of obligation and free of charge. If needed, we have a network of affordable professionals (accountants) who can help you with your tax obligations.

If you have more questions about FATCA, missing tax ID number, and US income tax you can contact us at Americans Overseas.

Contact us for more information

Source: International Investment

Frequently asked questions

Understanding the US tax system, the obligations, and all the additional terms can be difficult. Especially if one lives outside of America. Is your question not answered? Contact us.

-

Who is required to file taxes in the US?

U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income.

Read more... about Who is required to file taxes in the US? -

Do US citizens living abroad still have to file taxes in the US?

Yes, US citizens are required to file taxes on their worldwide income, regardless of where they are living.

Read more... about Do US citizens living abroad still have to file taxes in the US? -

How can I cash my US check?

Received an American check? You can cash your check in the following ways: cash the check at your own bank, transfer to another person (endorsement), cash checks using an online service or cash the check by another bank.

Read more... about How can I cash my US check? -

Are there any special tax forms required for US citizens living abroad?

US citizens living abroad may be required to file Form 2555 and/or Form 1116 to claim the foreign-earned income exclusion.

Read more... about Are there any special tax forms required for US citizens living abroad? -

What is FBAR filing?

FBAR (Foreign Bank Account Report) filing is the requirement for certain U.S. individuals and entities to report their foreign financial accounts to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. The FBAR filing requirement applies to U.S. persons who have a financial interest in, or signature authority over, one or more foreign financial accounts if the aggregate value of those accounts exceeds $10,000 at any time during the calendar year.

Read more... about What is FBAR filing?