U.S. tax authority struggles to process large numbers of tax returns

An investigation has shown that the IRS has fallen far short of its goals in implementing the FATCA legislation. With stricter requirements, the department hopes to more quickly detect non-compliance by Americans living and working abroad.

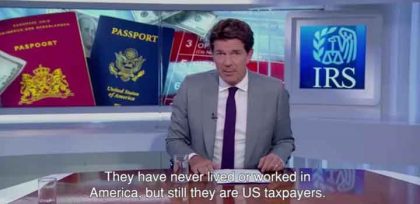

The American tax system, Citizen Based Taxation, has existed for over 150 years. However, many Americans living and working abroad did not know that this tax liability existed, but since the introduction of FACTA legislation, there is a real need for them to file tax returns in America.

FATCA legislation

FATCA (Foreign Account Tax Compliance Act), was introduced in 2010 to combat tax fraud and evasion. It requires financial institutions worldwide to share annual balances and contact information for Americans who have accounts.

The IRS can compare this information with the citizen’s filed tax returns.

In recent years, to avoid large fines, financial institutions have gone to great lengths to track down Americans in their customer base, contact them, and ask for their U.S. tax number (SSN or TIN).

Financial institutions go so far as to even close accounts of customers who are also U.S. citizens.

Painful conclusion in TIGTA report

Recently, a report by TIGTA (Treasury Inspector General for Tax Administration) made it painfully clear that the IRS has fallen far short of its goals in implementing the FATCA legislation

The IRS’s previously expected tax revenue of 8.7 billion is stuck at only 14 million. The IRS simply cannot process the data received and investigate the alleged fraud while investing $573 million.

Among other things, TIGTA’s research compared the number of Form 1099 tax returns issued by financial institutions to the number of tax returns received with investments. The differences are huge, the TIGTA translates this as a huge tax gap. In addition, TIGTA also notes that financial institutions’ reports to the IRS are often incomplete. They do not comply with the set rules in several areas if they are submitted at all by the financial institutions.

6 recommendations from TIGTA Implementing FATCA legislation

Recommendation 1:

The Commissioner, LB&I Division, should consider additional compliance actions for under reporters identified in its matching, including assessing penalties to taxpayers based on the variance amounts or conducting examinations on taxpayers who consistently underreport.

IRS management indicated that the recommendation has been implemented.

Recommendation 2:

Establish procedures that would identify non-filers of Forms 8938 and encourage compliance of non-filers through examination or penalty assessments.

IRS management stated that this recommendation has been implemented. It has a filter that identifies potential non-filers of Forms 8938, and civil and criminal examinations are underway with respect to the non-filer population.

Recommendation 3:

The Commissioner, LB&I Division, should consider expanding the scope of Campaign 975 to address non-compliance by the FFIs from IGA countries and follow-through with compliance action on the identified IGAs.

IRS management agreed with this recommendation and stated that Campaign 975 had reviewed approximately 4,000 FFls from IGA countries and identified potential noncompliance by 34 FFls. Compliance activities with respect to this population are underway.

Recommendation 4:

Issue a notice to foreign countries with Model 1 IGAs that all the FFIs must collect and provide the TINs of U.S. individuals owning a foreign bank account.

IRS management disagreed with this recommendation and stated that the countries with Model 1 IGAs are already aware that the FFIs must collect and provide the TINs of U.S. individuals owning a foreign bank account (e.g., Article 2, Model 1A Reciprocal IGA; Notice 2017-46).

Office of Audit Comment: We do not believe that assuming the FFIs are aware of an IRS notice from 2017 will correct the issue. The lack of a TIN continues to present challenges in enforcing FATCA compliance and makes it harder for the IRS to ensure compliance with the FFIs by using Form 8938 and ensure compliance by taxpayers by using Forms 8966.

We reported that for TYs 2016 to 2019, only 44 percent of the Forms 8966 the IRS received contained a valid TIN, while the remaining 56 percent contained an invalid TIN or had no TIN. We recommend an emphasis on this requirement.

Recommendation 5:

Establish goals, milestones, and timelines for FATCA campaigns in order to determine whether the campaigns are effective in meeting their goals and affecting tax compliance.

IRS management agreed with this recommendation. While stating that their existing campaign metrics track the progress and success of these campaigns, IRS management agreed to refine their metrics with respect to goals, milestones, and timelines.

Recommendation 6:

Partner with the SB/SE Division Directors for the Examination and Collection functions to establish an information-sharing program that would allow the SB/SE Division to conduct examinations and perform collection actions using Form 8938 data.

IRS management indicated that the recommendation has been implemented.

For the original report from the TIGTA, April 7, 2022, click here.

Confirmation Commissioner Rettig

IRS Commissioner Charles Rettig confirmed this in a committee meeting :

“The U.S. Congress passed FATCA in 2010, but we have yet to receive any significant funding for its implementation. This situation is exacerbated by the fact that when we detect potential non-compliance or fraudulent behavior through manually generated FATCA reports, we rarely have sufficient resources to pursue the information and ensure proper compliance.”

What does this mean for U.S. citizens abroad?

The IRS is clearly challenged for failing to achieve its goal of collecting taxpayer dollars and preventing tax fraud. The IRS has largely adopted and implemented the recommendations.

Controls on financial institutions and on tax returns are being tightened. There is a belief that there are many assets consciously or unconsciously hidden outside of America, and these are wanted to be uncovered as soon as possible.

Are you a US Person and not yet filing a tax return in America?

Get well-informed. In the Americans Overseas knowledge center, you’ll find lots of objective information about applying for an SSN and tax liability.

It also contains information on several repentance schemes, including the Streamlined Procedure, which allows you to return to the tax system penalty-free.

Do you have more questions? Contact Americans Overseas, and we’ll be happy to help, with no obligation and no cost.

Contact us for more information

Source: TIGTA

Frequently asked questions

Understanding the US tax system, the obligations, and all the additional terms can be difficult. Especially if one lives outside of America. Is your question not answered? Contact us.

-

Who is required to file taxes in the US?

U.S. citizens and resident aliens who live abroad are generally required to file a federal income tax return and pay taxes on their worldwide income.

Read more... about Who is required to file taxes in the US? -

Do US citizens living abroad still have to file taxes in the US?

Yes, US citizens are required to file taxes on their worldwide income, regardless of where they are living.

Read more... about Do US citizens living abroad still have to file taxes in the US? -

How can I cash my US check?

Received an American check? You can cash your check in the following ways: cash the check at your own bank, transfer to another person (endorsement), cash checks using an online service or cash the check by another bank.

Read more... about How can I cash my US check? -

Are there any special tax forms required for US citizens living abroad?

US citizens living abroad may be required to file Form 2555 and/or Form 1116 to claim the foreign-earned income exclusion.

Read more... about Are there any special tax forms required for US citizens living abroad? -

What is FBAR filing?

FBAR (Foreign Bank Account Report) filing is the requirement for certain U.S. individuals and entities to report their foreign financial accounts to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. The FBAR filing requirement applies to U.S. persons who have a financial interest in, or signature authority over, one or more foreign financial accounts if the aggregate value of those accounts exceeds $10,000 at any time during the calendar year.

Read more... about What is FBAR filing?