FBAR Penalties Are Spiraling Out of Control – and Ordinary Americans Overseas Are Paying the Price

It’s becoming increasingly common: people with U.S. citizenship who have managed their tax affairs in the Netherlands perfectly for years, yet never knew they were also required to file certain forms with the United States. A missed FBAR filing can suddenly be treated as if it were financial misconduct. The result is sometimes almost absurd – penalties many times higher than the actual tax owed.

A recent court case illustrates this painfully well. A man with both U.S. and Turkish nationality held several bank accounts in Turkey, with a highest combined balance of more than $800,000. He failed to file FBARs for these accounts over five years. Not because he tried to hide money, but simply because he was unaware of the American reporting requirement.

His U.S. tax liability for those years? $29,006.

The penalty imposed? $437,000.

No fraud. No money laundering. No offshore schemes. Just an administrative oversight — punished as if it were deliberate, severe misconduct.

When a Missed Form Weighs More Than Intent

The Foreign Bank and Financial Accounts (FBAR) rules originate from the Bank Secrecy Act of 1970, which was designed to target serious crime and offshore structures — the kind of activity intentionally kept out of sight of authorities.

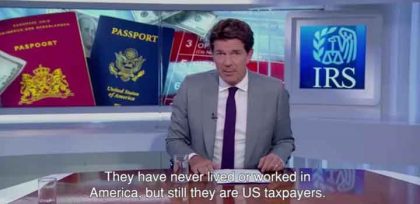

But in practice, these rules now primarily affect the very people they were never meant to target: Americans living abroad for decades, dual citizens who have never lived in the U.S., immigrants with savings in their country of origin, and individuals who acquired U.S. citizenship through an American parent.

In most cases, there is no intent to evade taxes. The issue is simply a lack of awareness of the U.S. reporting requirement. Yet a missed FBAR is quickly labeled as “willful” — a legal term that now includes recklessness, negligence, or even “should have known.”

Once the IRS considers a violation willful, penalties can reach 50% of the highest account balance per year. This leads to fines that are completely disconnected from proportionality: penalties based on account balance rather than actual tax owed.

A System That Collapses Under Its Own Logic

This is where things go fundamentally wrong. A system designed to catch serious offenders ends up punishing people acting in good faith. When an administrative error results in a penalty fifteen times higher than the tax due, it becomes difficult to argue that the policy is still reasonable.

We see this more and more in the Netherlands as well. Expats and accidental Americans who believed they were fully compliant discover years later that they missed a U.S. reporting obligation. Although they never intended to hide anything, they are still treated as willful offenders — simply because they didn’t know.

Why This Affects Everyone with U.S. Citizenship

Most people who contact Americans Overseas do not have offshore structures, complex investments, or hidden assets. They have ordinary checking and savings accounts, pension savings, or investments fully reported in the Netherlands.

But these individuals can still be hit hard because the U.S. rules do not align with their reality. The biggest risk is not knowing. Those unaware of their FBAR obligation fail to file — and the IRS may later treat these missing years as willful, with severe consequences.

What Can You Do?

The key is clarity. Understanding whether you must file FBAR, how to correct previous years, and which approach is safest can prevent an administrative mistake from turning into a financial disaster.

This requires specialized knowledge. Not every accountant or CPA understands European banking systems or the unique challenges faced by accidental Americans. That is why Americans Overseas provides free guidance to assess your situation and connect you with reliable, affordable specialists.

The System Must Become Fairer, but You Can Protect Yourself

FBAR penalties have escalated drastically in recent years. A system originally created to combat serious financial crime now affects ordinary people who never intended to do anything wrong. By seeking timely advice, you can prevent a missed form from becoming a life-altering penalty.

Americans Overseas continues to advocate for transparency, fairness, and protection for U.S. persons who unintentionally become trapped in overly complex and often disproportionate U.S. regulations.

Get informed with Americans Overseas

Do you doubt whether you filed your FBARs correctly, or fear you may have missed previous years?

We, the founders of Americans Overseas, were born in the Netherlands and acquired U.S. citizenship through our American mother.

When we first learned about the U.S.–Netherlands tax treaty around 2013, we felt disbelief (“this can’t be real”), frustration (“how is this allowed?”), fear (“will I get fined?”), and panic (“what should I do?”).

Unfortunately, the U.S. tax obligation is very real for Dutch individuals who acquired U.S. citizenship at birth. No government agency informed us. The consulate referred us to the IRS, and the IRS was impenetrable.

That is why we started this initiative: to provide reliable information, prevent unnecessary panic, and offer free and non-binding assistance. When needed, we connect you to experienced and affordable U.S. tax professionals who can help manage your obligations safely.

Contact us for more information

Sources FBAR penalties:

Forbes: The Rise And Proliferation Of Excessive FBAR Penalties

Bloomberg Tax: FBAR Penalty of $438,000 Not Unconstitutionally Excessive Fine

Taxnotes UNITED STATES OF AMERICA,Plaintiff, v. TUNCAY SAYDAM, Defendant.